U.S. Unemployment Rate Forecast for 2017 Is 4.6% But It’s Too Optimistic

The U.S. unemployment rate forecast for 2017 is 4.7%. That means no major change from 2016. The official numbers show that unemployment was falling just before the presidential election. The unemployment rate fell 0.3% in November 2016 compared to October.

At first, the sheer magnitude of the improvement should impress. But, on closer examination, it should raise concerns.

The unemployment rate in the U.S. and its purported improvements have a less impressive explanation. The improvement over the past year has resulted, at least in part, by a reduction in the numbers of people actively looking for jobs. Hiring has slowed in 2016. (Source: “U.S. job creation weak, even as unemployment rate falls to 4.7%,” CNN, June 3, 2016.)

In May of 2016, the economy added just 38,000 jobs. That was the lowest monthly job number statistic since 2010. (Source: Ibid.)

Real Unemployment Rate Could Hit 30% by 2020. Trump Thinks It’s Already There

Trump is right not to trust the official statistics. He already believes the real U.S. unemployment rate to be considerably higher. During the presidential campaign of 2016, Trump convinced many supporters that the real jobless figures were closer to 28%–35% than to official figure.

Five percent unemployment was the official target during the last administration. That target has been reached and improved, but Steven Mnuchin, the Secretary of the Treasury, has backed President Trump’s view. “The unemployment rate is not real … I’ve traveled for the last year. I’ve seen this.” said Mnuchin to the Senate Finance Committee. (Source: “Ahead Of Trump’s First Jobs Report, A Look At His Remarks On The Numbers,” NPR, January 29, 2017.)

The real unemployment rate rarely has anything to do with the actual unemployment rate. Confusing the two may have been one of the fatal mistakes made by Democratic presidential candidate Hillary Clinton. In the months preceding the Democratic Party convention, unemployment appeared to be going down.

For the record, in 2010, the economy was still in full post-2008 crisis mode. Thus, there can be but one conclusion: U.S. jobless numbers dropped because too many Americans grew frustrated and stopped looking for work. When an economy pushes so many of its productive members of society to such frustration, it’s no occasion to celebrate.

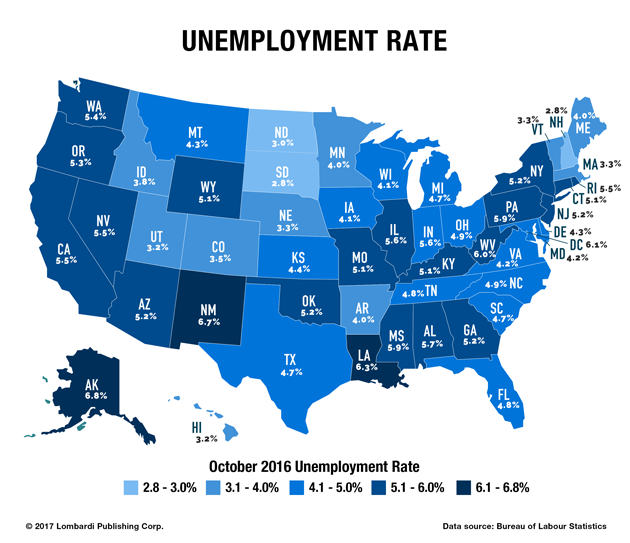

Then there’s the regional distribution of unemployment that also contributes to social schisms. The unemployment rate by state varies significantly.

The states with the highest unemployment rates are as surprising as they are indicative of labor market turmoil. As of September 2016, apart from Puerto Rico (a territory, not a state)—which has an unemployment rate of 11.6%—the highest official unemployment rates by state were New Mexico (6.7%), Louisiana (6.4%), Mississippi (6.0%), Nevada (5.8%), and Pennsylvania (5.7%).

It’s interesting to note that Pennsylvania has been a traditional Democratic Party stronghold in presidential elections, yet Pennsylvanians voted for Trump. Correlation is not causation but, if traditionally Democratic voters switch to a Republican with a clear message of addressing the problem of declining job numbers and the weakening U.S. labor force, it suggests that the real unemployment rate is much worse than the story that the numbers tell.

Official Narrative Is That Donald Trump Has Inherited a Healthy Economy

The stock market has shot up like New Year’s Eve fireworks, but how healthy is the economy when real jobless numbers are hidden behind deceptive statistics? The official numbers measure unemployment by taking into consideration only people formally looking for work.

These are the people receiving unemployment benefits and, as such, they are registered into the system as part of the U.S. labor force looking for work. It would be safe to suggest that these numbers especially account for people who have been unemployed for a period ranging from zero to one year. What happens when the benefits run out before they find a new job?

Donald Trump was elected in a country where the official unemployment rate in November 2016 fell to 4.6%, which was its lowest level in nine years. Some 178,000 jobs were supposedly created in November alone. Why then did so many vote for Trump, who ran a campaign that was doubtless trying to capture the attention of the jobless?

In other words, if the U.S. economy was so great that it had generated such high job numbers, why didn’t Hillary Clinton win? After all, she promised to uphold Barack Obama’s policies. Well, the alleged job creation achievements of the Obama administration can only be addressed by the discouragement factor that skews the real unemployment rate.

The simple reason, in large part, is that, many unemployed Americans give up finding a job. Anyone who has ever submitted a resume knows how frustrating and emotionally draining a job search can be. Donald Trump tapped into that feeling. It was one of the main themes of his campaign.

The problem illustrates what, in the eyes of many Americans, is the paradox of the allegedly healthy U.S. economy. The stock market is buoyant and equities are at record highs yet, to so many, the economy is in a terrible state. And these unemployed people don’t fit any stereotype. They include skilled professionals, engineers, managers, factory workers, and retail sales assistants.

Middle Class Faces More Unemployment

The new phenomenon might be just how much unemployment has hit the middle class. In fact, Trump secured many votes among the angry and frustrated middle class. The protest vote from the American middle class was the very driver of the U.S. election results. The polls—and one must wonder where pollsters went and whom they interviewed—failed to get a sense of the anger.

The polls and the optimistic Obama-loving media missed a fundamental fact. They overlooked it because they were too busy gushing over the performance of stock market indices. What they ignored is a phenomenon that economists have described as labor polarization (or the polarization of labor). Yet, U.S. Federal Reserve Chair Janet Yellen has spoken about it often. (Source: “Yellen’s ‘Polarization’ A New, More Ominous Jobs Factor,” EFXNews, August 25, 2014.)

Yellen has made no secret of the fact that she believes polarization is a major problem. She suggests that it’s much more troubling as a technical objective than keeping the U.S. unemployment rate at below five percent.

So, what is this polarization of labor?

Work in America, in recent years, has been characterized by what can be described as a dualism. On the one hand, there has been an explosion of the so-called Uberization of work. That is, on-demand work in which the worker is only partially an employee. Often, as in the case of Uber, workers must supply their own equipment or property.

This Uberization of work, however, has one important effect: intermittent incomes. On the polar opposite side (hence the term “polarization”), we find the highly paid and highly educated engineers who work for the Silicon Valley-type companies. Often, they create the work that leads to Uberization. In between, there’s little else.

The direct consequence of this phenomenon has been a massive rise in inequality. The polarization of the labor market has strangled the middle class. When the much-praised Obama started his first term as president in January 2009, he said in his inaugural address that the Wall Street crisis represented a great opportunity for change.

So, what has really changed? Yes, the official unemployment rate is just below five percent. At the height of the financial crisis in 2008, it rose to 10% but steadily declined. Still, something is missing, because Trump won by tapping into a pervasive sense of economic depression. The only conclusion must be that Obama has not met his target.

Middle America Feels Left Out

Many Americans still feel left out. In fact, they feel abandoned by the traditional political leadership. If you are looking for proof that the real unemployment rate is much higher than they’re telling us, look to the White House. Who is sitting in the Oval Office? Trump’s win is the proof.

But it’s not Obama’s fault. He was merely the latest president to confront an unemployment or underemployment problem that started in the 1990s. It was at the height of the Bill Clinton bull market that the American middle class stopped being able to save. Consumption has grown, but it has been fueled by credit cards and mortgages, often of the sub-prime variety.

Then there was the 2008 financial crisis. It was prompted, nobody should forget, by a gradual rise in interest rates to curb the real estate bubble. That made it harder for people to pay back their debts. Savings were wiped out.

Since the so-called recovery, American families have had to rely only on salaries and payroll benefits. But even these were greatly scaled down.

The welfare and social security benefits they enjoyed in the past have had to face reality checks as well. Even the formerly powerful unions, where they still had any clout, had to accept significant cuts in exchange for keeping jobs and new hires. Now that Yellen is urging at least two more interest rate hikes, the financial and economic picture is approaching an eerie similarity to 2007.

Then, as now, many banks are overleveraged in derivatives. It will take just one event, a black swan that nobody has foreseen, to send the whole market crashing, and the economy with it. In 2008, the unemployment rate spiked from about 4.5% to 10% overnight. The very same could happen next month or next year.

The crucial point is that nothing has changed to avert a catastrophe, and the next crisis could hit harder than previous ones. In 2017, compared to 2008, salaries, wages, and benefits have been resized (shrunk). There’s also more precarious—or Uberized—employment than before. Discontent is already high. The market gains are benefiting an ever-smaller group of people, who always seem to get richer.

Add to this the increase in personal taxes. Meanwhile, so-called blue-collar jobs have moved to countries where wages and other production costs are lower. Trump has been trying to bring some of the jobs back, but the numbers are too small to make a significant dent. Meanwhile, labor costs have become so competitive internationally that even Chinese companies are outsourcing!

But Trump hasn’t got all the answers either. His protectionist prescription for the economy could end up causing a global recession. To really change the employment numbers, more dramatic solutions are needed. In the wake of the 1929 crash, the economy gradually recovered after a series of policies was adopted.

These include the reduction of working hours to employ more people at the expense of efficiency. Meanwhile, social protections were gained through generous welfare programs while banks and the financial system were slapped with restrictions to better manage risk. Overly free-market solutions in post-World War I Germany led to the socioeconomic disaster of Nazism.

Then there’s the issue of robotization. Technology is simply going to wipe out many jobs in the next decade. Whole sectors will be made redundant. At that point, even the official U.S. unemployment rate could match the real unemployment rate of 28–30% that Trump and Mnuchin mentioned.

At these current levels, unemployment can hardly go lower, because everything is based on the index of investor confidence. And to invest, you must trust the future. Sooner, rather than later, the markets will face reality.